About Cresmont Equity Mineral Resources

The reasons to invest in natural resources have always been compelling. Whether it's lumber, coal, or gold, natural resources are at the core of production. The screen you are using to read this article is just a collection of natural resources that have been processed and reprocessed. The pool of investable natural resources is growing as the world population requires more and more of these resources. In this article, we'll look at why you might want to consider natural resource investing and how to go about it.

Incomes increase in developing countries, the demand for precious metals, building materials, and other natural resources tends to increase as well. Although a supply shock is still a potential risk with many resources, such as oil, rising demand generally leads to rising prices;

Global infrastructure and repair: developing countries have a huge appetite for gravel, lumber, steel, and other materials needed to build roads and other public works. This building spree is being prompted by population growth and increasing urbanization. Similarly, much of the infrastructure in developed nations require updating on a regular basis, and the more decades that pass before repairs and updates are made, the larger the eventual spending will be;

Political buying: a number of nations have begun buying up natural resources to ensure a consistent supply of crucial raw materials.

This buying sometimes takes the form of political agreements and sometimes outright open market orders or foreign acquisitions, making governments another driver of demand;

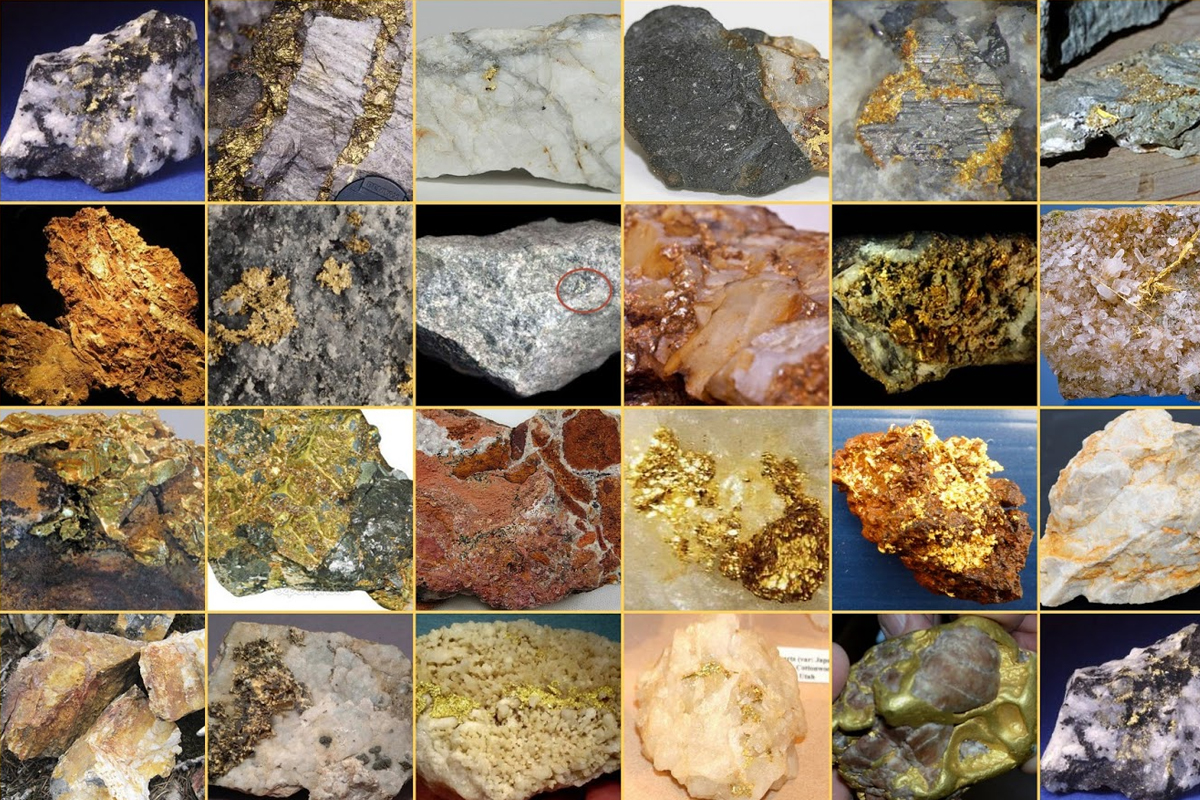

Store of value: many natural resources act as a store of value, particularly metals. These resources become more attractive when inflation threatens investors.

There is also an argument that natural resources have a low correlation with the financial sector.

This is broadly true, as many companies continue to hold consumer natural resources investments well into a financial downturn, in hopes of being well-positioned for a rebound. However, as more and more of the activity in natural resources is being driven by investment and speculation, this lower correlation is likely to turn into a higher one.